In the UAE’s fast-evolving marketplace, tax compliance can’t be overlooked—whether you’re a large corporation or a freelance designer. A central requirement is the Tax Registration Number, or TRN, which you can’t get VAT registered without. In this guide, we’ll explore why TRN verification is a must-do for any tax filer in the UAE, walk you through the verification process, and highlight the key reasons you’ll want to double-check this number today.

What is a TRN in the UAE?

The TRN is a single, unique code the FTA assigns to each business and person registered under the country’s VAT system. Launched in 2018, the VAT law makes it compulsory for anyone supplying goods or services that are liable for tax to officially register and secure this number. The TRN then becomes a way for the FTA to monitor and audit VAT transactions in real time.

Eligibility for Obtaining a TRN

Any business whose taxable turnover hits AED 375,000 annually must register and get a TRN. Companies falling slightly below that—turnover between AED 187,500 and AED 375,000—can choose to register voluntarily but still need the number. Even individual freelancers and sole traders whose services generate taxable income need a TRN before they can begin collecting VAT.

Why is TRN Verification Important?

Verifying the TRN keeps your business aligned with VAT laws and shields you from costly fines. Here’s why this step can’t be skipped:

- Stops Fraud and Non-Compliance: Entering the wrong TRN can be the start of tax fraud, and penalties can be severe. A simple check makes sure everything is above board.

- Smooths Daily Deals: If you’re making a VAT-eligible sale, you need your partner’s TRN checked. A valid TRN gives you the right VAT treatment, stopping double taxation and making refunds easier.

- Avoids Costly Charges: If you send the wrong TRN to the FTA, you could face a fine. Regular checks keep penalties at bay and your paperwork on point.

How to Verify TRN in the UAE?

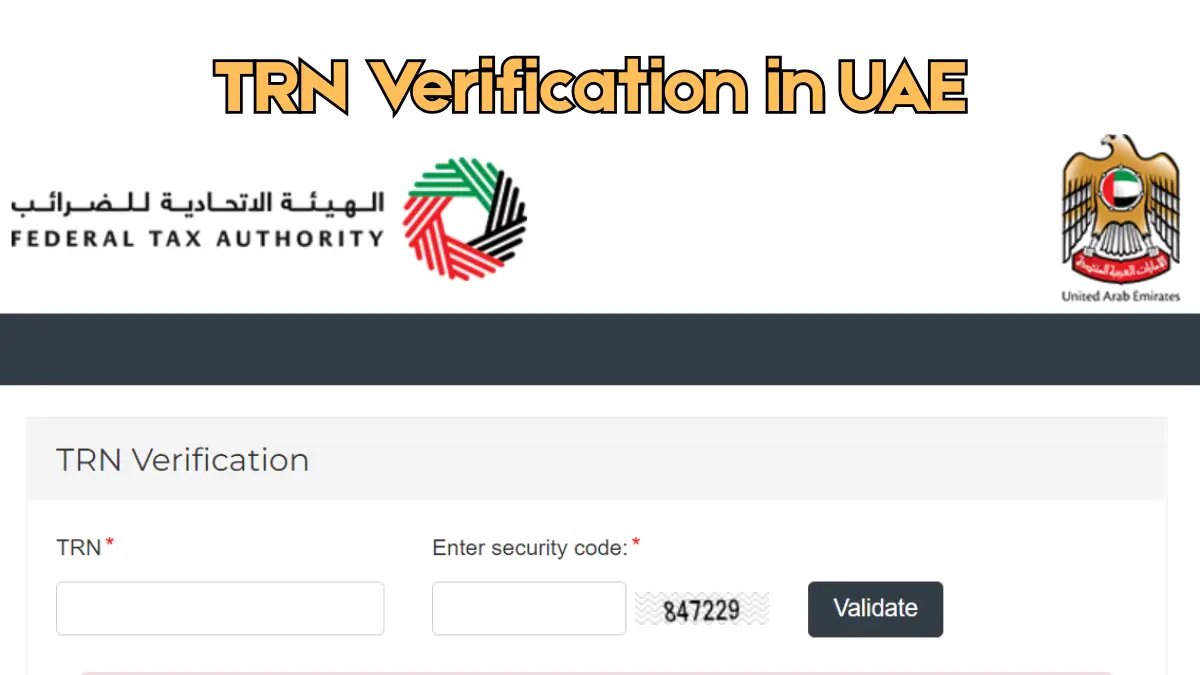

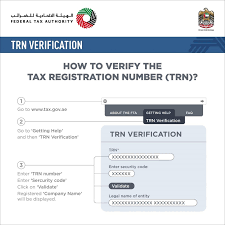

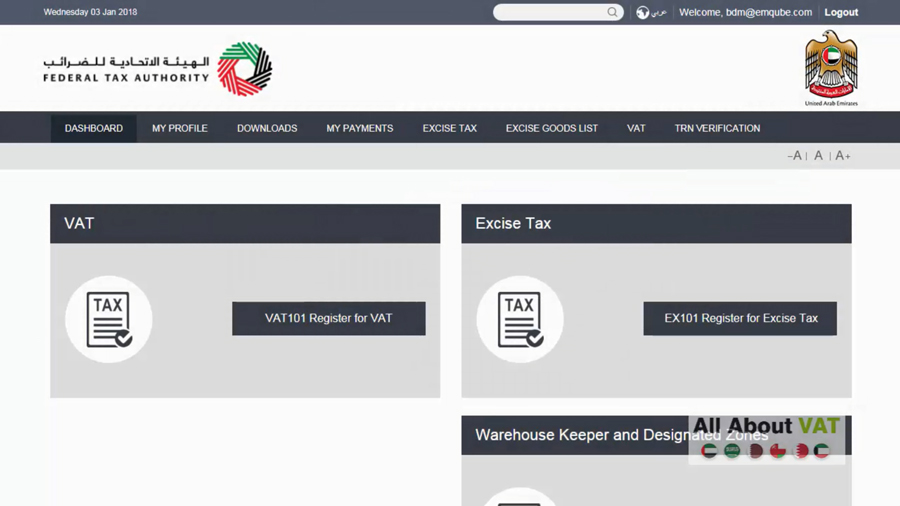

TRN verification in the UAE is easy through the FTA’s website. Here’s a quick guide:

- Go to the FTA’s Online Portal: Head to the FTA website and look for the TRN verification tool.

- Enter the TRN: Type the TRN number exactly, including any hyphens or spaces.

Check the Verification Result

After entering the TRN, click the “Verify” button. If the TRN is correct, the portal will confirm success in a pop-up message. If it’s incorrect, the portal will give you a simple prompt asking you to check the TRN again.

Take Action if Invalid

Should the system tell you that the TRN is not valid, the business will need to fix the problem with the FTA. You can do this either by correcting the existing registration or by submitting a request for a new TRN.

While using the FTA portal is the safest way to confirm a TRN, some third-party services offer TRN checks in bulk. Be extra careful, though, and only use services that the FTA officially approves.

Common Issues and Mistakes in TRN Verification

Here are the common problems you may run into when verifying the TRN, along with simple fixes.

- Typographical Errors: A missing or wrong character can block verification. Always double-check each digit.

- Incorrect Format: Make sure the format is the same as the original. Missing dashes or extra spaces will cause an error.

- Mismatch of Information: If the name or other business details don’t match the FTA’s records, the TRN will not pass. In this case, your only choice is to contact the FTA to clear up the mismatch.

If your TRN verification doesn’t go through, act right away so you don’t run into bigger problems. You might need to reach out to the FTA to update your TRN or even submit a brand-new application.

TRN Verification for International Transactions

Going global? That makes TRN checks even more crucial. The UAE—and many other nations—won’t allow cross-border shipments without a valid TRN. Always confirm the TRN of your international trade partner to steer clear of headaches down the road. When a TRN is valid, VAT is charged the right way, and you can get refunds when the law allows. That means cash flow stays healthy.

TRN verification is also your insurance against global tax issues. Selling goods into the UAE? The buyer is on the hook to confirm the seller’s TRN to keep VAT records straight.

TRN and VAT Compliance in the UAE

In the UAE, TRN checks are non-negotiable for VAT compliance. Anyone registered for VAT has to keep filing VAT returns on schedule, and the FTA watches those filings through TRNs. No valid TRN? No filing. That’s a clear path to fines. Protect your business and keep your TRN verified.

Consequences of Non-Compliance

If a business in the UAE doesn’t have a valid Tax Registration Number (TRN), the consequences can be serious. Companies risk being penalized for not filing their VAT returns on time. They also lose the chance to claim VAT refunds and could even end up facing legal action. Plus, operating without a valid TRN makes it tough to carry out VAT-eligible deals with both suppliers and customers.

TRN Verification and VAT Audits

The Federal Tax Authority (FTA) carries out regular audits to check that businesses are following VAT rules. During these audits, inspectors will look at a company’s TRN to confirm that all VAT returns are accurate. Having a valid TRN makes the audit process smoother for everyone involved and helps to steer clear of unwanted fines.

TRN Verification for New Businesses and Startups

For new companies setting up in the UAE, checking that the TRN works is one of the very first steps in VAT compliance. After a business registers for VAT, the FTA sends a TRN that the business must verify and keep up-to-date for as long as it operates. Startups sometimes run into obstacles at this stage, like typos in the registration details or mismatched records. Checking the TRN right away can stop these small issues before they turn into bigger headaches.

Best Practices for Startups

- Make sure the registration information with the FTA is 100% accurate.

- Periodically check that the TRN is still valid and that no flags have appeared.

- Stay proactive and resolve any issues promptly.

TRN Verification Services and Tools

The FTA portal is still the safest choice for checking your TRN. Still, some companies may find third-party tools helpful. A good software lets you verify many TRNs in bulk, which saves time for larger businesses.

Before you choose software, double-check that the provider is FTA-approved. Going with an unverified service could expose your sensitive data to security threats. Authorized tools will do the check quickly and comply with UAE tax regulations.

Legal Implications of TRN Verification

Not verifying or mistakenly entering a TRN can have serious legal outcomes. Companies may incur steep fines, face court actions, or receive penalties for failing to comply.

A wrong TRN can cause issues during a VAT audit or an international trade transaction. Keeping an updated and verified TRN record is your best defense against VAT and tax compliance headaches.

Conclusion

For any business or individual involved in taxables in the UAE, verifying your TRN is non-negotiable. A valid TRN is the backbone of VAT registration, compliant transactions, and precise tax filing. Regular checks safeguard you from FTA penalties and keep your business on the right side of the law.

Whether you’re launching a new business or you’ve been running a company for years, make sure your TRN (Tax Registration Number) is valid and current. Doing this helps your daily operations run smoothly, protects you from penalties, and keeps you compliant with VAT laws in the UAE.

FAQ’s

What role does the Federal Tax Authority (FTA) play in TRN verification?

The FTA is the agency that issues and checks TRNs for UAE VAT-registered businesses.

Can a third-party service provider check a TRN?

Yes, third-party providers can verify TRNs, but you should always choose a reputable and FTA-authorized provider.

How long does TRN verification take?

If you verify a TRN through the FTA’s online portal, the process is immediate. If you see a problem, contact the FTA right away to fix it.

What should I do if there’s a problem with my TRN?

If you spot errors or discrepancies in your TRN, contact the FTA as soon as possible to get the issue corrected.

You May Also Like:

RPay Balance Enquiry in UAE | Al Rostamani Card Balance Check

Fewa Quick Pay | A Convenient Way to Pay Your Utility Bills in the UAE

Share this article

Written by : UAE Script Staff

Follow us

A quick overview of the topics covered in this article.

Latest articles

February 3, 2026

February 3, 2026

February 3, 2026